AlphaPoint:

Goal: To extend AlphaPoint’s white-label ecosystem to produce a general “Swiss Army Knife” of crypto solutions, particularly adding the ability for real-world asset digitization and smart baskets/indices for crypto assets.

Role:

Design Lead (Solo Designer)

Business Impact:

– 0-1 Creation of Asset Digitization Platform

– Created modular blockchain toolkit for myriad use cases

– Launched 3 clients on platform

– Created ecosystem for new AlphaPoint products

Client:

AlphaPoint

Skills:

– Research

– UX/UI

– Design Systems

– Client Engagement

Timeframe:

1 Year

Project Overview

Context and Challenge: The vision for APAD was to create a comprehensive, white-label marketplace capable of handling a diverse range of digital assets, including real-world asset-backed tokens and general cryptocurrency. The challenge lay in designing a platform that was modular to adapt to myriad “crypto” business needs of customers, but also expand AlphaPoint’s offerings to include the key ability to digitize real-world assets. This means creating a system that could tokenize hard-to-sell assets like real estate or fine art, making them tradable in a blockchain-based marketplace, and thereby opening new investment avenues in traditionally illiquid assets.

Approach: Building off AlphaPoint’s APEX crypto trading platform, new features were iteratively introduced through multiple releases, catering to specific “customer” requirements and general platform development. A significant part of the design process involved balancing customer-specific use cases with the broader goal of creating a generic but versatile set of solutions for the marketplace.

Outcome: The APAD platform emerged as a pioneering solution in asset digitization, enabling the launch of three diverse customers on the platform and creating a foundational ecosystem for new AlphaPoint products. At the time, its modular “Crypto Swiss Army Knife” design and ability to tokenize a range of assets made it an invaluable tool for “crypto” businesses seeking customized digital asset exchange solutions.

Successes and Challenges

0 to 1 Design – Looking for Product Fit

APAD was built to digitize real-world assets (RWAs) and to build exchanges in which the assets would be traded. This involved creating a blockchain Swiss Army Knife that could meet the needs of many use cases for marketplaces for RWAs (Real World Assets).

Client-Driven Design

When AlphaPoint develops new technology, they typically do it with a client use case so that they can use the cash inflow to finance the build out. As a client has specific use cases, it was often difficult to “genericize” what we were building to apply to other customers.

Blockchain Swiss-Army Knife

As AlphaPoint provides white-label software to enable clients to trade crypto, APAD required much more functionality then a typical exchange. We had to think about legal aspects of representing RWAs with smart contracts and the various entities that would engage with the platform such as Operators, Issuers, and Investors.

Sales

As a platform, APAD was purchased by 3 customers. It’s technology was later retrofitted into a NFT tokenization product.

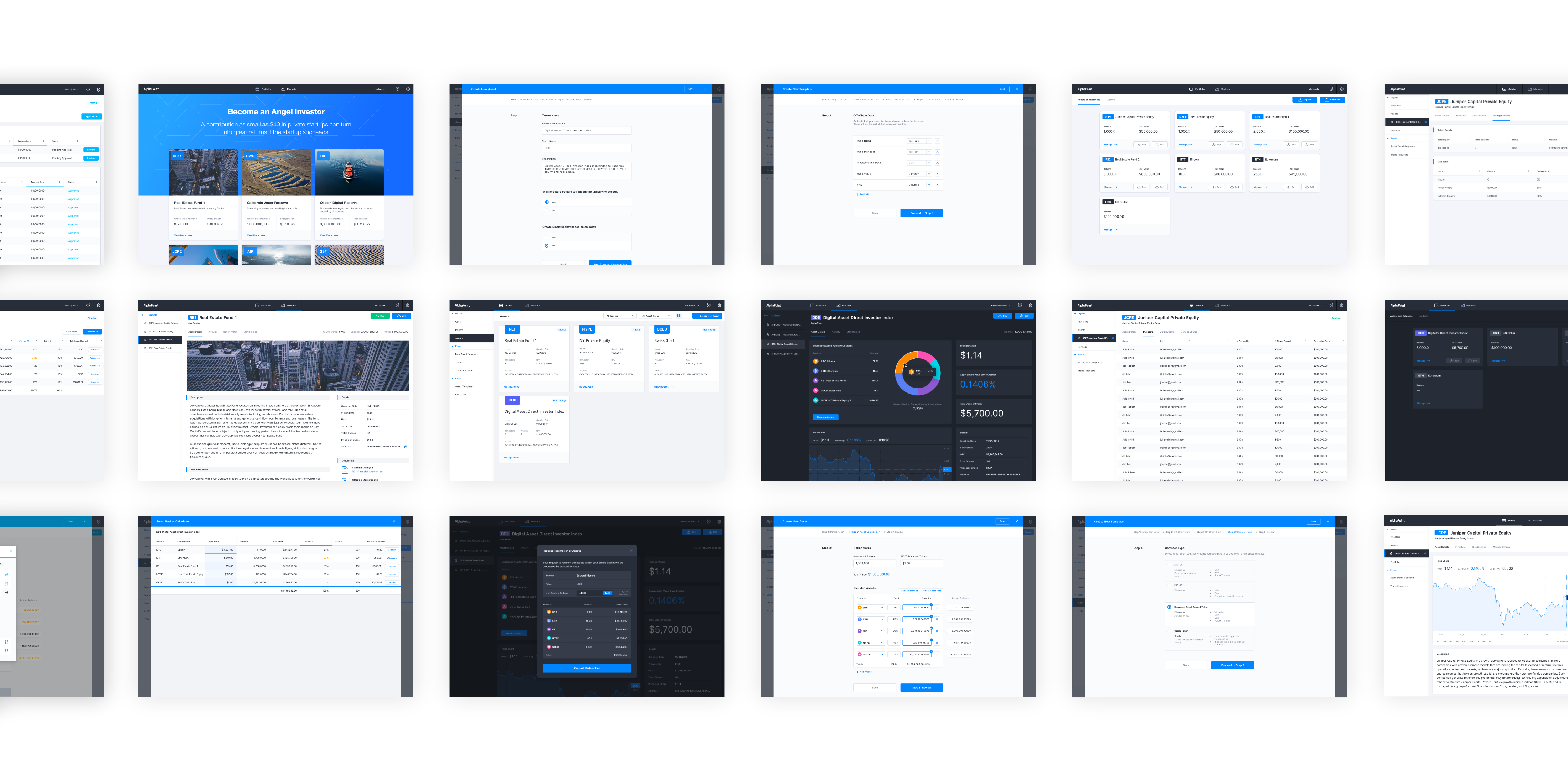

APAD: Multi-Feature Asset Digitalization Platform and Crypto Exchange

Modularity:

- Marketplace

- Trading

- Crypto & Custom Asset Tokens

- Wallets

- Transfers

- Asset Token Creation

- Entity Types (Operator, Issuer, Investor)

- Admin Functionality

- Special Features: Indices & Baskets

- User Verification: KYC & AML

- Data Visualization

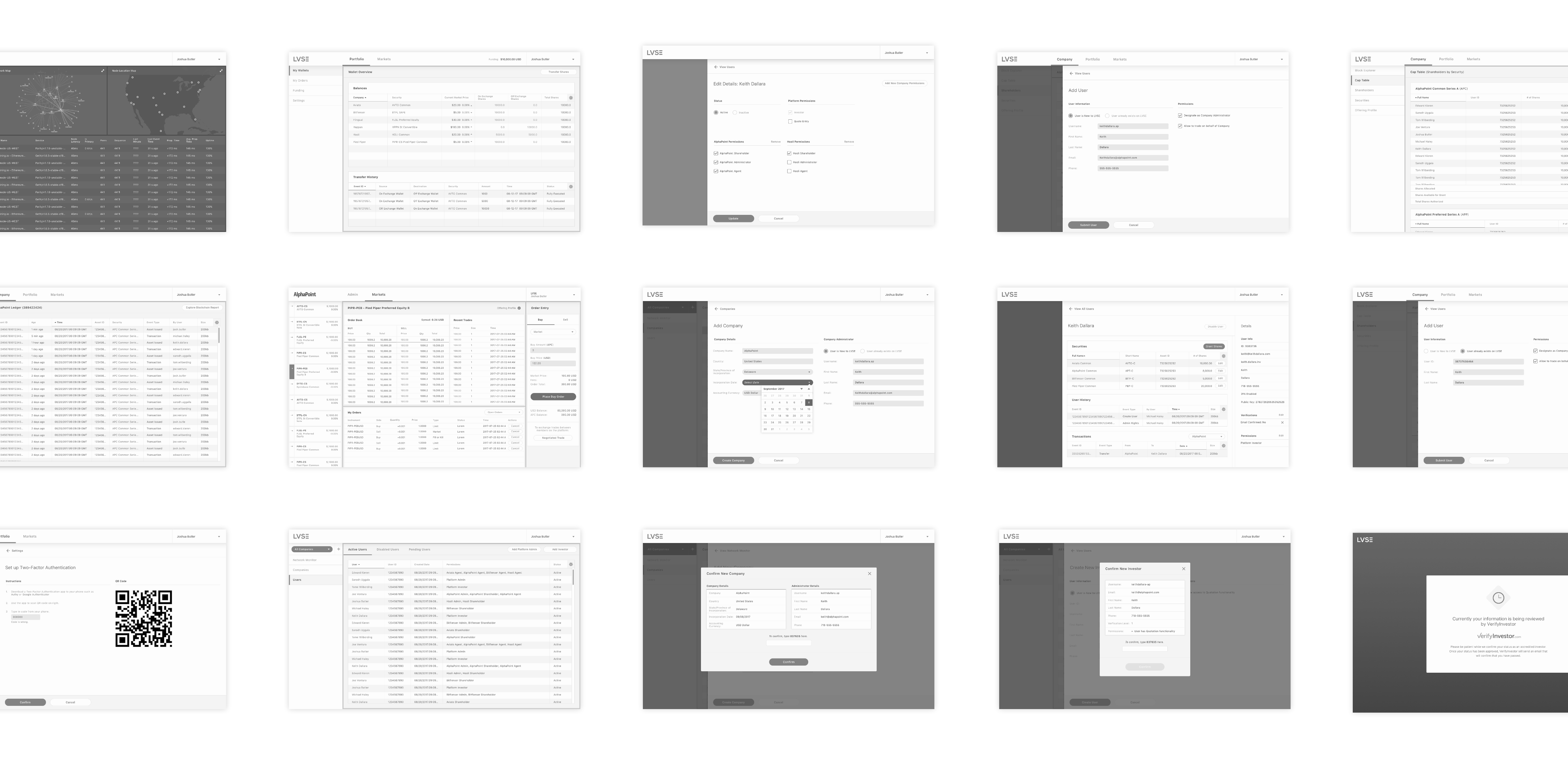

First Client: The Beginning of the APAD Platform

Early Days:

With the first client’s financing, APAD began as a mutually beneficial partnership. Low-fidelity mockups were refined into a functional platform, prioritizing business requirements over UI and performance.

A start-up called LVSE (Las Vegas Stock Exchange) contributed financing for this initial work.

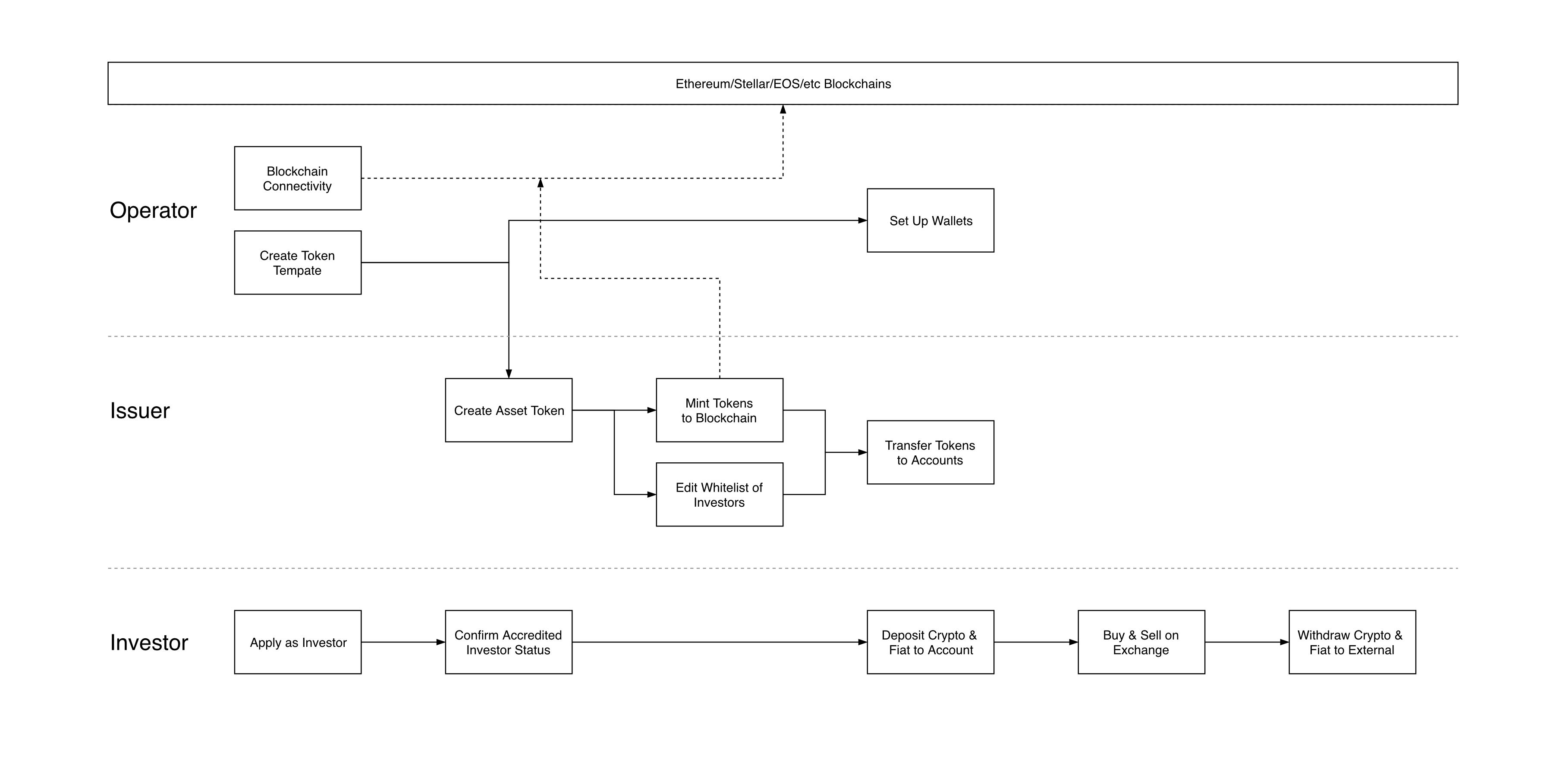

Entity Types and Tasks

The System:

APAD provides multiple use cases for various asset classes and entities, illustrated by the diagram above. Roles may shift between the operator and the issuer.

Breakdown of User Types:

- “Operators” – Run the exchange; help Issuers be successful

- “Issuers” – List and manage tokens; distribute assets to investors

- “Investors” – Invest in assets on the exchange

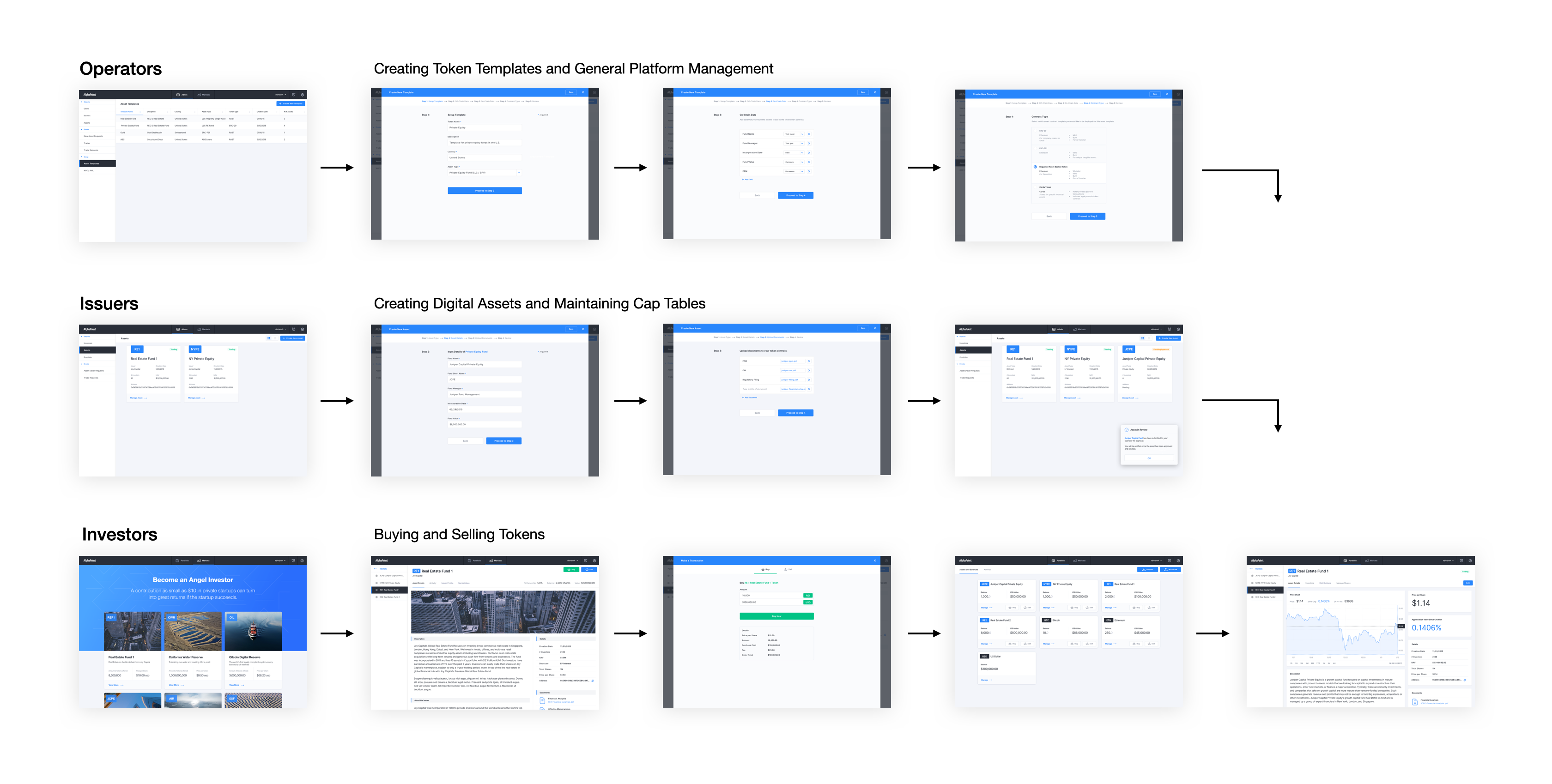

The APAD Experience

In Short:

- Quick example of how an asset token is created, listed on an exchange, and sold to an investor.

- More details below

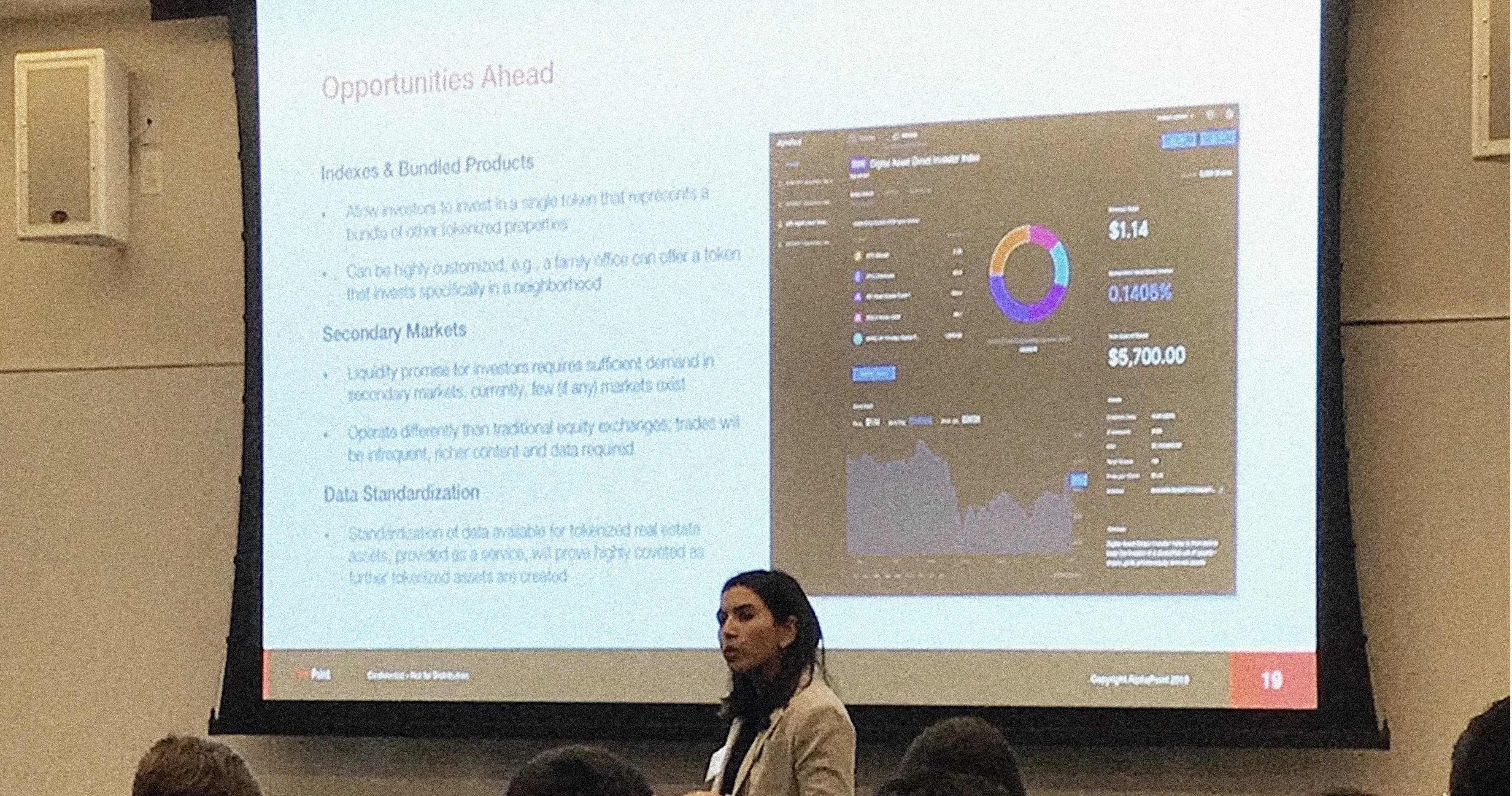

Roadshow

- At the time, there really wasn’t a white-label product like APAD

- Numerous events were held to show it’s potential

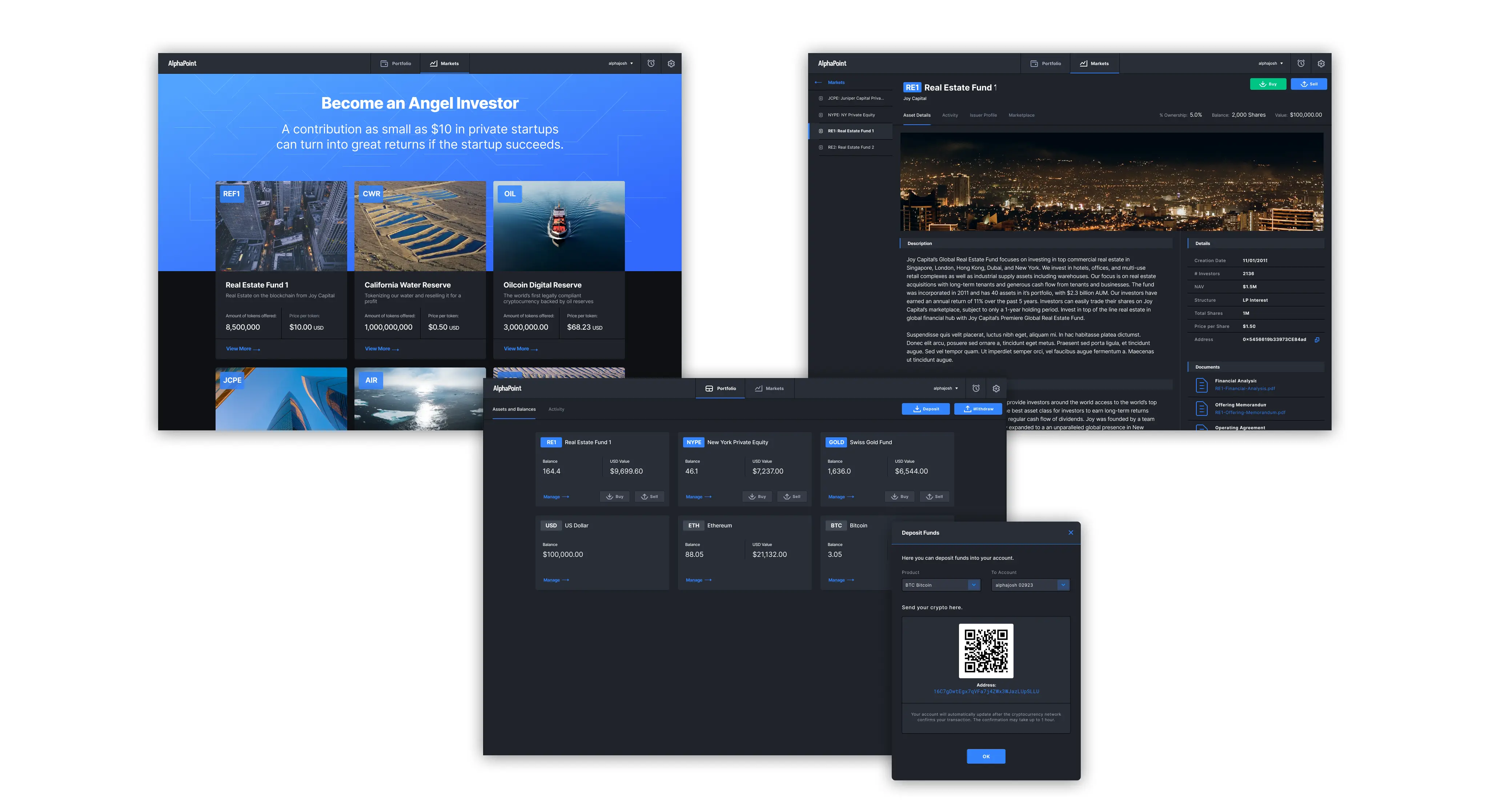

Investor Experience

Features:

- Token Marketplace

- Token Detail Page for Investors

- Investor Wallet Dashboard

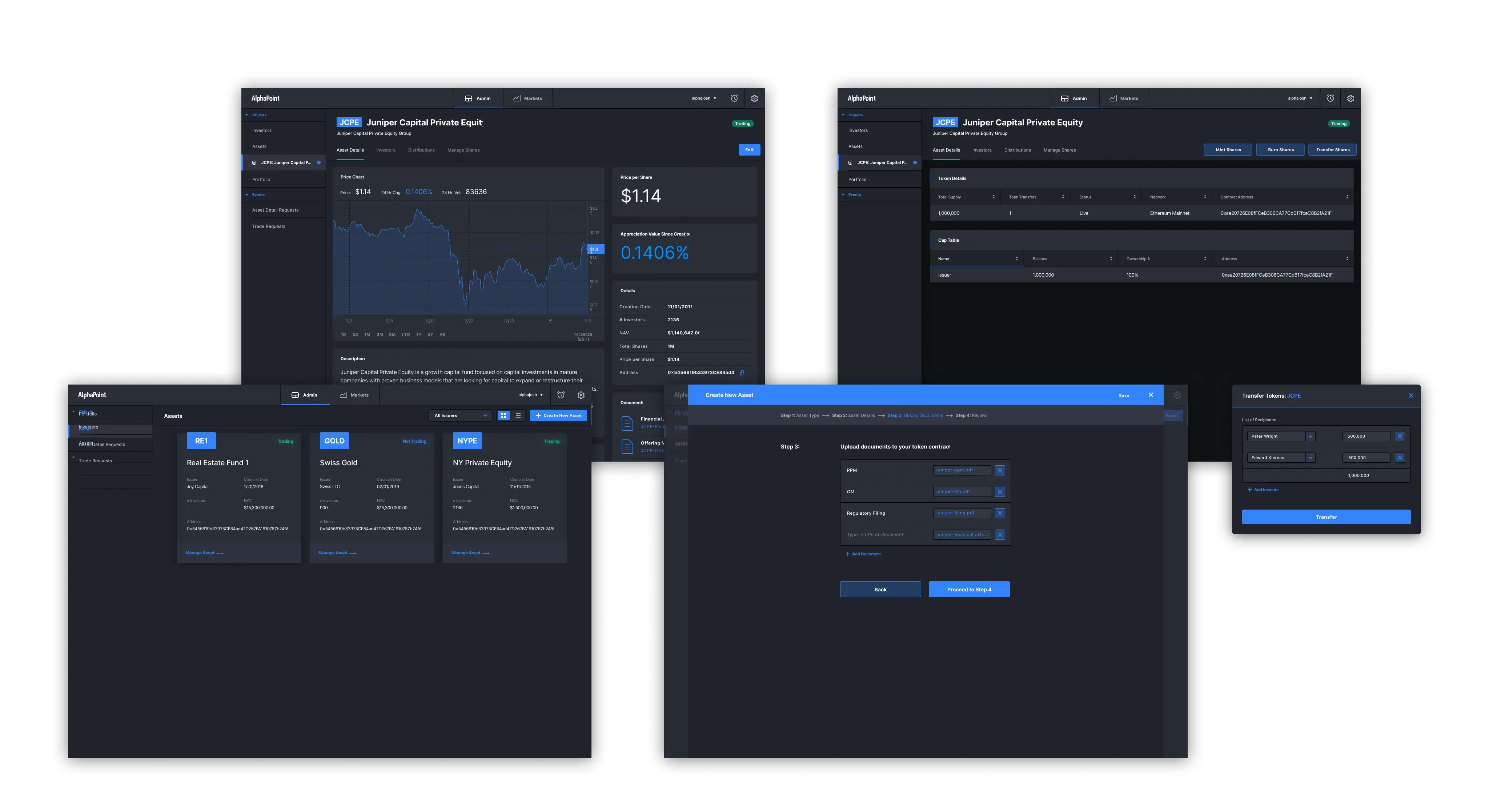

Issuer Experience

Features:

- Issuer Asset Token Inventory

- Token Dashboard

- Token Creation Wizard

- Ad-hoc Token Transfers

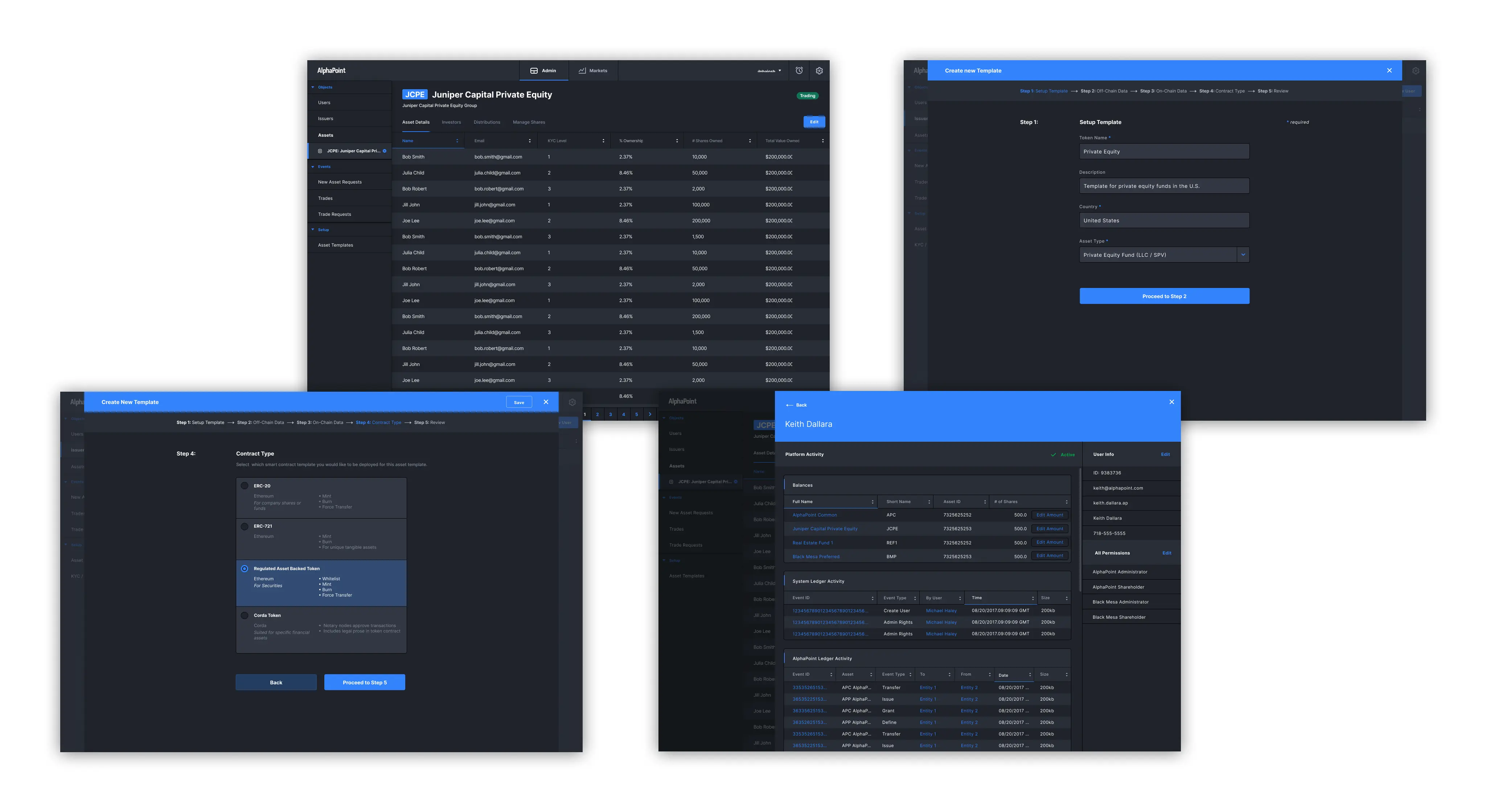

Operator Experience

Features:

- Operator view of all Issuers and Investors on Platform

- Token Detail – Investor View

- Asset Token Template creation wizard

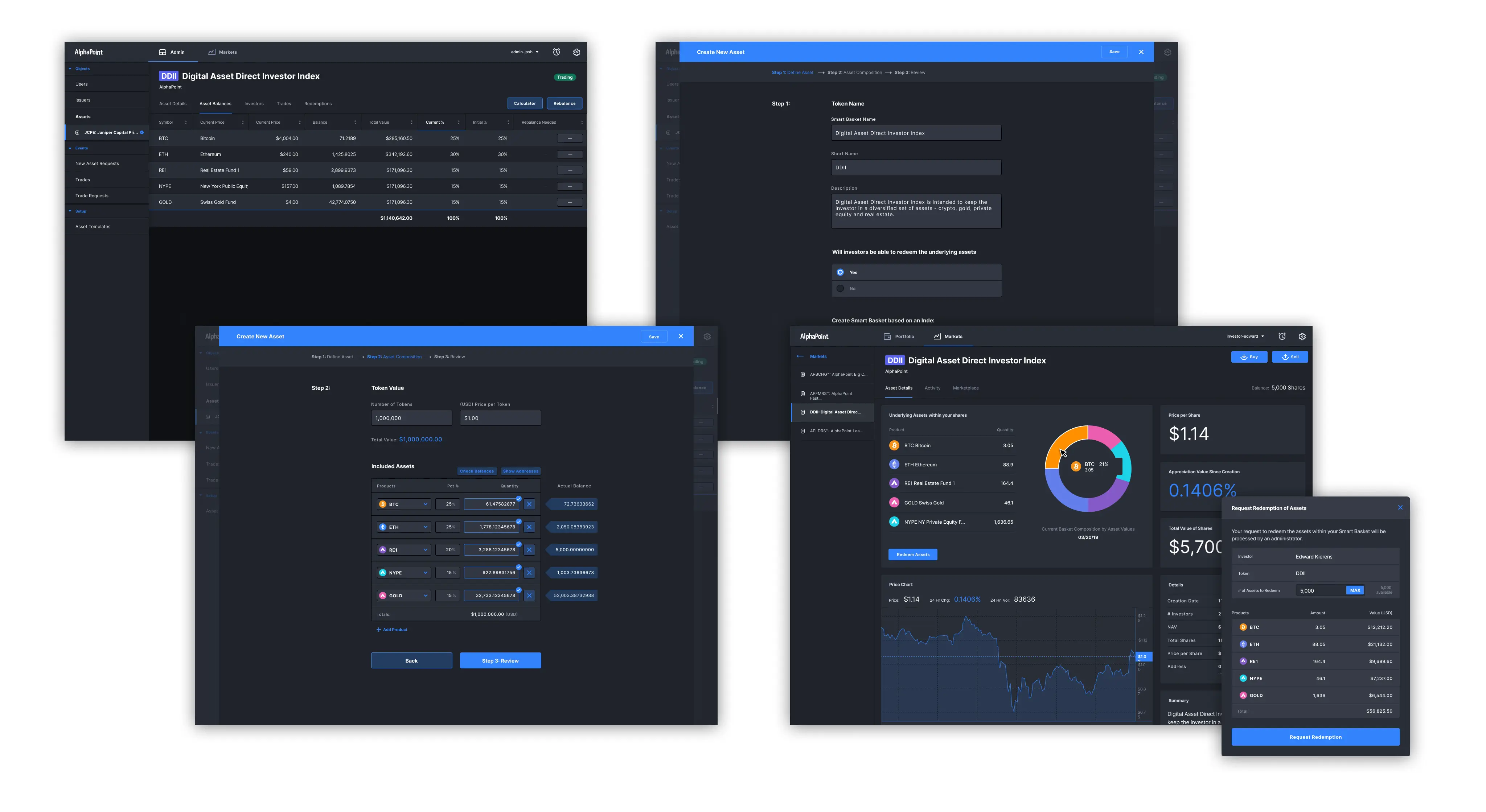

Special Feature: Smart Baskets

In Short:

- The idea is to combine multiple cryptocurrencies and digital assets into a single bundle

- Backed by RABT (Real Asset-Backed Tokens)

- The creation flow is to choose what assets go into the basket and then the percentages and number of tokens

- As prices fluctuate, the smart basket can be rebalanced

- Users who purchase Smart Baskets can redeem them to receive the individual tokens